The money printing presses of the developed economies are operating at full speed as the US, Japan and Europe have all announced monetary “easing” measures seen as necessary to spur stagnant economic growth.

Analysts are concerned that the massive increases in money supply in numerous nations will spark a global “currency war”, thus worsening China’s external economic environment.

This enormous infusion of cash wil increase global liquidity, push up the prices of risky assets and attract the capital to flow into the developing countries for higher investment returns.

As result of the new round of liquidity, China will be forced to confront challenges in dealing with imported inflation, maintaining and increasing the value of forex reserves and preventing the inflow of hot money.

This excess liquidity from the West will result in a huge amount of cheap capital travelling the world and looking for returns, thus disrupting commodity markets and increasing prices of the imported goods which are important to people’s livelihood.

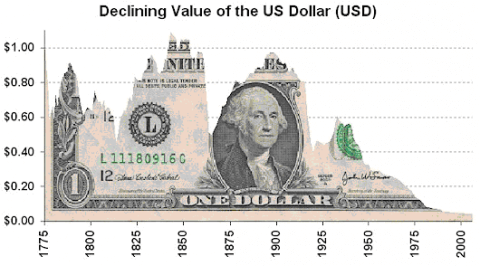

Since these increases in the Western money supply are purely inflationary, they will lead to a serious reduction in the value of China’s foreign exchange reserves – which is the intent, in large part.

This inflationary international hot money will not only make forex management more difficult, but creates risks of domestic asset bubbles in China, especially in housing and securities.

Statistics indicated that before and after the U.S. announced the second round of QE in 2010, many US investment banks including Morgan Stanley, Goldman Sachs, UBS had poured huge amounts of money into China’s real estate markets, and were in large part responsible for the crisis in housing costs.

The same happened with Hong Kong, where prices rose by almost 90% within a few years. These US banks take the free money provided by the FED, and use it to make profits by creating and bursting bubbles in other economies. This has been a consistent pattern.

|

P & G China Alumni Weekly News Bulletin

|

http://exmail.qq.com/cgi-bin/frame_html?sid=21LtHKdyrmRtghlI,7&r=35b9ee454b70d969fabb63d641314f8a

The facts talked about inside the write-up are several of the most effective out there