As the Whig Party geared up for the presidential elections of 1840, the United States was mired in a deep depression. While that depression had been brought on by the Jackson Administration’s dismantling of the Second Bank of the United States, there was not broad public recognition of that fact. People were simply scrambling to survive.

Into the breach stepped the young politician from Illinois, Abraham Lincoln. Nationally, his party had determined to sidestep many of the substantive issues facing the nation, choosing instead to promote its candidate, William Henry Harrison, on the basis of his war record and humble origins.

But Lincoln decided to devote his campaigning to one critical issue, restoring the Bank of the United States.

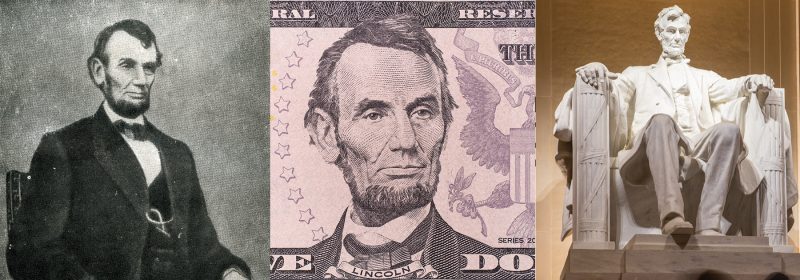

Abraham Lincoln as a young man.

Lincoln gave innumerable speeches on this subject, but only one, given in Springfield, Illinois on December 26, 1839, survives.

In that speech, he echoed many of the arguments given by the founder of the first Bank of the United States, Alexander Hamilton.

Indeed, the speech was so thorough and compelling in its arguments that the Whig Party decided to print it as a campaign pamphlet.

Lincoln’s advocacy for the bank put him on the national political stage long before most historians have placed him there.

Like many of his speeches, Lincoln’s address on the National Bank was lengthy.

Yet, in 1839-40, thousands of citizens sat and listened, while others read it in the local newspaper or the pamphlet.

If they could do it, so can we.

The question is: Will we join his fight for Hamiltonian banking?

I’m reprinting nearly whole speech below.

But first, some more context about what Lincoln was discussing.

The Second National Bank

After the nation’s disastrous financial problems during the War of 1812, the Second Bank of the United States was established in 1816, using the same Hamiltonian method of public credit as the first.

Stockholders had to pay for three-quarters of their shares in government bonds, and one quarter in specie (gold or silver).

Total capitalization was set at $35 million, making it huge for its day.

The bank was the depository for federal government funds, and its scrip could be used to pay taxes.

The BUS functioned as a commercial bank, creating a de facto common currency for the nation’s farmers, merchants, and entrepreneurs, and greatly thus improving conditions for commercial activity.

After a period of inept management for its first few years, the Bank came under the control of Nicholas Biddle, and began to play its proper function.

Not only did it furnish funds to private and state investors, allowing them to build a growing network of canals, and a host of burgeoning industries, but it was authorized to channel Federal government funds into infrastructure projects as well.

This activity took off during the presidency of John Quincy Adams, who himself had a far-sighted program for internal improvements of all kinds.

The result was the kind of banking which Alexander Hamilton envisioned as key to the American System: providing government-backed credit to carry out projects to promote the general welfare.

Second Bank of the United States, built on Hamilton’s principles.

It took a concerted propaganda war run by a popular war hero President Jackson to destroy this successful economic system.

As a result, credit dried up for farmers and entrepreneurs everywhere; the new government’s demands for paying in cash (specie) brought new hardships to the very people whom Jackson had riled up to hate the “monster bank.”

The ultimate result came under the Van Buren Administration which followed Jackson’s, with the crash of 1837. That crash’s effects were still abundant when Lincoln gave this speech.

Fast Forward

Lincoln’s 1840 campaign was successful, in the sense that not only was Harrison elected, but a bill establishing a new National Bank was passed by the incoming Congress.

But the move was aborted when the President died of a mysterious illness, and his vice-president, John Tyler, took the Jacksonian position of vetoing the legislation.

There ensued a period dominated by the chaos which Lincoln predicted would occur under the Sub-Treasury plan.

Local scrip proliferated, many infrastructure plans were cancelled, and the nation’s “wealth” became more and more tied to the slave-based cotton trade.

By the time Lincoln was elected in 1860, the nation’s coffers were vastly depleted.

A national banking system, both to fund the war and advance the economy with internal improvements and new modern industries, therefore became a top priority for the President.

And while he chose to propose a different path than establishing a National Bank, the principles he laid out in 1840 are clearly visible in the national banking system he set up, many aspects of which we still follow today.

Lincoln’s speech

FELLOW CITIZENS: It is peculiarly embarrassing to me to attempt a continuance of the discussion, on this evening, which has been conducted in this Hall on several preceding ones.

It is so, because on each of those evenings, there was a much fuller attendance than now, without any reason for its being so, except the greater interest the community feel in the Speakers who addressed them then, than they do in him who is to do so now.

I am, indeed, apprehensive, that the few who have attended, have done so, more to spare me of mortification, than in the hope of being interested in anything I may be able to say.

This circumstance casts a damp upon my spirits, which I am sure I shall be unable to overcome during the evening.

But enough of preface.

The subject heretofore, and now to be discussed, is the Sub-Treasury scheme of the present Administration, as a means of collecting, safe-keeping, transferring and disbursing the revenues of the Nation, as contrasted with a National Bank for the same purposes.

Mr. Douglass has said that we (the Whigs), have not dared to meet them (the Locos), in argument on this question. I protest against this assertion.

I assert that we have again and again, during this discussion, urged facts and arguments against the Sub-Treasury, which they have neither dared to deny nor attempted to answer.

But lest some may be led to believe that we really wish to avoid the question, I now propose, in my humble way, to urge those arguments again; at the same time, begging the audience to mark well the positions I shall take, and the proof I shall offer to sustain them, and that they will not again permit Mr. Douglass or his friends, to escape the force of them, by a round and groundless assertion, that we “dare not meet them in argument.”

Stephen A. Douglas was the spokesman for the Democratic Party’s Sub-Treasury scheme.

Of the Sub-Treasury then, as contrasted with a National Bank, for the before enumerated purposes, I lay down the following propositions, to wit:

1st. It will injuriously affect the community by its operation on the circulating medium.

2d. It will be a more expensive fiscal agent.

3d. It will be a less secure depository of the public money.

Cutting Back Credit

To show the truth of the first proposition, let us take a short review of our condition under the operation of a National Bank.

It was the depository of the public revenues.

Between the collection of those revenues and the disbursements of them by the government, the Bank was permitted to, and did actually loan them out to individuals, and hence the large amount of money annually collected for revenue purposes, which by any other plan would have been idle a great portion of time, was kept almost constantly in circulation.

Any person who will reflect, that money is only valuable while in circulation, will readily perceive, that any device which will keep the government revenues, in constant circulation, instead of being locked up in idleness, is no inconsiderable advantage.

By the Sub-Treasury, the revenue is to be collected, and kept in iron boxes until the government wants it for disbursement; thus robbing the people of the use of it, while the government does not itself need it, and while the money is performing no nobler office than that of rusting in iron boxes.

The natural effect of this change of policy, every one will see, is to reduce the quantity of money in circulation.

But again, by the Sub-Treasury scheme the revenue is to be collected in specie. I anticipate that this will be disputed. I expect to hear it said, that it is not the policy of the Administration to collect the revenue in specie.

If it shall, I reply, that Mr. Van Buren, in his message recommending the Sub-Treasury, expended nearly a column of that document in an attempt to persuade Congress to provide for the collection of the revenue in specie exclusively; and he concludes with these words.

“It may be safely assumed, that no motive of convenience to the citizen, requires the reception of Bank paper.” In addition to this, Mr. Silas Wright, Senator from New York, and the political, personal and confidential friend of Mr. Van Buren, drafted and introduced into the Senate the first Sub-Treasury Bill, and that bill provided for ultimately collecting the revenue in specie.

It is true, I know, that that clause was stricken from the bill, but it was done by the votes of the Whigs, aided by a portion only of the Van Buren Senators.

No Sub-Treasury bill has yet become a law, though two or three have been considered by Congress, some with and some without the specie clause; so that I admit there is room for quibbling upon the question of whether the administration favor the exclusive specie doctrine or not; but I take it, that the fact that the President at first urged the specie doctrine, and that under his recommendation the first bill introduced embraced it, warrants us in charging it as the policy of the party, until their head as publicly recants it, as he at first espoused it—I repeat then, that by the Sub-Treasury, the revenue is to be collected in specie.

Now mark what the effect of this must be.

By all estimates ever made, there are but between 60 and 80 millions of specie in the United States.

The expenditures of the Government for the year 1838, the last for which we have had the report, were 40 millions.

Thus it is seen, that if the whole revenue be collected in specie, it will take more than half of all the specie in the nation to do it.

By this means more than half of all the specie belonging to the fifteen million of souls, who compose the whole population of the country, is thrown into the hands of the public office-holders, and other public creditors, composing in number, perhaps not more than one-quarter of a million; leaving the other fourteen millions and three-quarters to get along as they best can, with less than one-half of the specie of the country, and whatever rags and shin-plasters they may be able to put, and keep, in circulation.

By this means, every office-holder, and other public creditor, may, and most likely will, set up shaver; and a most glorious harvest will the specie men have of it; each specie man, upon a fair division, having to his share, the fleecing of about 59 rag men.

In all candor, let me ask, was such a system for benefiting the few at the expense of the many, ever before devised?

And was the sacred name of Democracy, ever before made to endorse such an enormity against the rights of the people?

A cartoon of the devastation from the 1837 crash.

I have already said that the Sub-Treasury will reduce the quantity of money in circulation.

This position is strengthened by the recollection, that the revenue is to be collected in specie, so that the mere amount of revenue is not all that is withdrawn, but the amount of paper circulation that the 40 millions would serve as a basis to, is withdrawn; which would be in a sound state at least 100 millions.

When 100 millions, or more, of the circulation we now have, shall be withdrawn, who can contemplate, without terror, the distress, ruin, bankruptcy and beggary, that must follow.

The man who has purchased any article, say a horse, on credit, at 100 dollars, when there are 200 millions circulating in the country, if the quantity be reduced to 100 millions by the arrival of pay-day, will find the horse but sufficient to pay half the debt; and the other half must either be paid out of his other means, and thereby become a clear loss to him; or go unpaid, and thereby become a clear loss to his creditor.

What I have here said of a single case of the purchase of a horse, will hold good in every case of a debt existing at the time a reduction in the quantity of money occurs, by whomsoever, and for whatsoever it may have been contracted.

It may be said, that what the debtor loses, the creditor gains by this operation; but on examination this will be found true only to a very limited extent. It is more generally true that all lose by it.

The creditor, by losing more of his debts, than he gains by the increased value of those he collects; the debtor by either parting with more of his property to pay his debts, than he received in contracting them; or, by entirely breaking up in his business, and thereby being thrown upon the world in idleness.

The general distress thus created, will, to be sure, be temporary, because whatever change may occur in the quantity of money in any community, time will adjust the derangement produced; but while that adjustment is progressing, all suffer more or less, and very many lose every thing that renders life desirable.

Why, then, shall we suffer a severe difficulty, even though it be but temporary, unless we receive some equivalent for it?

What I have been saying as to the effect produced by a reduction of the quantity of money, relates to the whole country.

I now propose to show that it would produce a peculiar and permanent hardship upon the citizens of those States and Territories in which the public lands lie.

The Land Offices in those States and Territories, as all know, form the great gulf by which all, or nearly all, the money in them, is swallowed up.

When the quantity of money shall be reduced, and consequently every thing under individual control brought down in proportion, the price of those lands, being fixed by law, will remain as now.

Of necessity, it will follow that the produce or labor that now raises money sufficient to purchase 80 acres, will then raise but sufficient to purchase 40, or perhaps not that much.

And this difficulty and hardship will last as long, in some degree, as any portion of these lands shall remain undisposed of.

Knowing, as I well do, the difficulty that poor people now encounter in procuring homes, I hesitate not to say, that when the price of the public lands shall be doubled or trebled; or, which is the same thing, produce and labor cut down to one-half or one-third of their present prices, it will be little less than impossible for them to procure those homes at all.

In answer to what I have said as to the effect the Sub-Treasury would have upon the currency, it is often urged that the money collected for revenue purposes will not lie idle in the vaults of the Treasury; and, farther, that a National Bank produces greater derangement in the currency, by a system of contractions and expansions, than the Sub-Treasury would produce in any way.

In reply, I need only show, that experience proves the contrary of both these propositions.

It is an undisputed fact, that the late Bank of the United States, paid the Government $75,000 annually, for the privilege of using the public money between the times of its collection and disbursement.

Can any man suppose, that the Bank would have paid this sum, annually for twenty years, and then offered to renew its obligations to do so, if in reality there was no time intervening between the collection and disbursement of the revenue, and consequently no privilege of using the money extended to it?

Martin van Buren was a leading architect of the anti-bank campaign

Again, as to the contractions and expansions of a National Bank, I need only point to the period intervening between the time that the late Bank got into successful operation and that at which the Government commenced war upon it, to show that during that period, no such contractions or expansions took place.

If before, or after that period, derangement occurred in the currency, it proves nothing.

The Bank could not be expected to regulate the currency, either before it got into successful operation, or after it was crippled and thrown into death convulsions, by the removal of the deposits from it, and other hostile measures of the Government against it.

We do not pretend, that a National Bank can establish and maintain a sound and uniform state of currency in the country, in spite of the National Government; but we do say, that it has established and maintained such a currency, and can do so again, by the aid of that Government; and we further say, that no duty is more imperative on that Government, than the duty it owes the people, of furnishing them a sound and uniform currency.

Which System Costs More?

I now leave the proposition as to the effect of the Sub-Treasury upon the currency of the country, and pass to that relative to the additional expense which must be incurred by it over that incurred by a National Bank, as a fiscal agent of the Government.

By the late National Bank, we had the public revenue received, safely kept, transferred and disbursed, not only without expense, but we actually received of the Bank $75,000 annually for its privileges, while rendering us those services.

By the Sub-Treasury, according to the estimate of the Secretary of the Treasury, who is the warm advocate of the system and which estimate is the lowest made by any one, the same services are to cost $60,000.

Mr. Rives, who, to say the least, is equally talented and honest, estimates that these services, under the Sub-Treasury system, cannot cost less than $600,000.

For the sake of liberality, let us suppose that the estimates of the Secretary and Mr. Rives, are the two extremes, and that their mean is about the true estimate, and we shall then find, that when to that sum is added the $75,000, which the Bank paid us, the difference between the two systems, in favor of the Bank, and against the Sub-Treasury, is $405,000 a year.

This sum, though small when compared to the many millions annually expended by the General Government, is, when viewed by itself, very large; and much too large, when viewed in any light, to be thrown away once a year for nothing.

It is sufficient to pay the pensions of more than 4,000 Revolutionary Soldiers, or to purchase a 40-acre tract of Government land, for each one of more than 8,000 poor families.

To the argument against the Sub-Treasury, on the score of additional expense, its friends, so far as I know, attempt no answer.

They choose, so far as I can learn, to treat the throwing away $405,000 once a year, as a matter entirely too small to merit their democratic notice.

Securing the Public’s Money

I now come to the proposition, that it would be less secure than a National Bank, as a depository of the public money.

The experience of the past, I think, proves the truth of this.

And here, inasmuch as I rely chiefly upon experience to establish it, let me ask, how is it that we know any thing—that any event will occur, that any combination of circumstances will produce a certain result—except by the analogies of past experience?

What has once happened, will invariably happen again, when the same circumstances which combined to produce it, shall again combine in the same way.

We all feel that we know that a blast of wind would extinguish the flame of the candle that stands by me.

How do we know it?

We have never seen this flame thus extinguished.

We know it, because we have seen through all our lives, that a blast of wind extinguishes the flame of a candle whenever it is thrown fully upon it.

Again, we all feel to know that we have to die.

How?

We have never died yet.

We know it, because we know, or at least think we know, that of all the beings, just like ourselves, who have been coming into the world for six thousand years, not one is now living who was here two hundred years ago.

I repeat then, that we know nothing of what will happen in future, but by the analogy of experience, and that the fair analogy of past experience fully proves that the Sub-Treasury would be a less safe depository of the public money than a National Bank. Examine it.

By the Sub-Treasury scheme, the public money is to be kept, between the times of its collection and disbursement, by Treasurers of the Mint, Custom-house officers, Land officers, and some new officers to be appointed in the same way that those first enumerated are.

Has a year passed since the organization of the Government, that numerous defalcations have not occurred among this class of officers?

Look at Swartwout with his $1,200,000, Price with his $75,000, Harris with his $109,000, Hawkins with his $100,000, Linn with his $55,000, together with some twenty-five hundred lesser lights.

Place the public money again in these same hands, and will it not again go the same way? Most assuredly it will.

But turn to the history of the National Bank in this country, and we shall there see, that those Banks performed the fiscal operations of the Government thro’ a period of 40 years, received, safely kept, transferred, disbursed, an aggregate of nearly five hundred millions of dollars; and that, in all that time, and with all that money, not one dollar, nor one cent, did the Government lose by them. Place the public money again in a similar depository, and will it not again be safe?

But, conclusive as the experience of fifty years is, that individuals are unsafe depositories of the public money, and of forty years that National Banks are safe depositories, we are not left to rely solely upon that experience for the truth of those propositions.

If experience were silent upon the subject, conclusive reasons could be shown for the truth of them.

The Sub-Treasury scheme called for keeping government funds at the Treasury, rather than put them to work through a National Bank. Shown, Construction of the U.S. Treasury building in the 1860s.

It is often urged, that to say the public money will be more secure in a National Bank, than in the hands of individuals, as proposed in the Sub-Treasury, is to say, that Bank directors and Bank officers are more honest than sworn officers of the Government.

Not so. We insist on no such thing. We say that public officers, selected with reference to their capacity and honesty, (which by the way, we deny is the practice in these days,) stand an equal chance, precisely, of being capable and honest, with Bank officers selected by the same rule.

We further say, that with however much care selections may be made, there will be some unfaithful and dishonest in both classes. The experience of the whole world, in all by-gone times, proves this true.

The Saviour of the world chose twelve disciples, and even one of that small number, selected by superhuman wisdom, turned out a traitor and a devil.

And, it may not be improper here to add, that Judas carried the bag—was the Sub-Treasurer of the Saviour and his disciples.

We then, do not say, nor need we say, to maintain our proposition, that Bank officers are more honest than Government officers, selected by the same rule.

What we do say, is, that the interest of the Sub-Treasurer is against his duty—while the interest of the Bank is on the side of its duty.

Take instances—a Sub-Treasurer has in his hands one hundred thousand dollars of public money; his duty says—You ought to pay this money over”—but his interest says,You ought to run away with this sum, and be a nabob the balance of your life.”

And who that knows anything of human nature, doubts that, in many instances, interest will prevail over duty, and that the Sub-Treasurer will prefer opulent knavery in a foreign land, to honest poverty at home?

But how different is it with a Bank?

Besides the Government money deposited with it, it is doing business upon a large capital of its own.

If it proves faithful to the Government, it continues its business; if unfaithful, it forfeits its charter, breaks up its business, and thereby loses more than all it can make by seizing upon the Government funds in its possession.

Its interest, therefore, is on the side of its duty—is to be faithful to the Government, and consequently, even the dishonest amongst its managers, have no temptation to be faithless to it.

Even if robberies happen in the Bank, the losses are borne by the Bank, and the Government loses nothing.

It is for this reason then, that we say a Bank is the more secure.

It is because of that admirable feature in the Bank system, which places the interest and the duty of the depository both on one side; whereas that feature can never enter into the Sub-Treasury system.

By the latter, the interest of the individuals keeping the public money, will wage an eternal war with their duty, and in very many instances must be victorious.

In answer to the argument drawn from the fact that individual depositories of public money, have always proved unsafe, it is urged that even if we had a National Bank, the money has to pass through the same individual hands, that it will under the Sub-Treasury.

This is only partially true in fact, and wholly fallacious in argument.

It is only partially true, in fact, because by the Sub-Treasury bill, four Receivers General are to be appointed by the President and Senate.

These are new officers, and consequently, it cannot be true that the money, or any portion of it, has heretofore passed thro’ their hands.

These four new officers are to be located at New York, Boston, Charleston, and St. Louis, and consequently are to be the depositories of all the money collected at or near those points; so that more than three-fourths of the public money will fall into the keeping of these four new officers, which did not exist as officers under the National Bank system. It is only partially true, then, that the money passes through the same hands, under a National Bank, as it would do under the Sub-Treasury.

It is true, that under either system, individuals must be employed as Collectors of the Customs, Receivers at the Land Offices, &c. &c. but the difference is, that under the Bank system, the receivers of all sorts, receive the money and pay it over to the Bank once a week when the collections are large, and once a month when they are small, whereas, by the Sub-Treasury system, individuals are not only to collect the money, but they are to keep it also, or pay it over to other individuals equally unsafe as themselves, to be by them kept, until it is wanted for disbursement.

It is during the time that it is thus lying idle in their hands, that opportunity is afforded, and temptation held out to them to embezzle and escape with it.

A contemporary cartoon showing the corruption of the Jackson Treasury and the Sub-Treasury system.

By the Bank system, each Collector or Receiver, is to deposit in Bank all the money in his hands at the end of each month at most, and to send the Bank certificates of deposit to the Secretary of the Treasury.

Whenever that certificate of deposit fails to arrive at the proper time, the Secretary knows that the officer thus failing, is acting the knave; and if he is himself disposed to do his duty, he has him immediately removed from office, and thereby cuts him off from the possibility of embezzling but little more than the receipts of a single month.

But by the Sub-Treasury System, the money is to lie month after month in the hands of individuals; larger amounts are to accumulate in the hands of the Receivers General, and some others, by perhaps ten to one, than ever accumulated in the hands of individuals before; yet during all this time, in relation to this great stake, the Secretary of the Treasury can comparatively know nothing.

Reports, to be sure, he will have, but reports are often false, and always false when made by a knave to cloak his knavery.

Long experience has shown, that nothing short of an actual demand of the money will expose an adroit peculator.

Ask him for reports and he will give them to your heart’s content; send agents to examine and count the money in his hands, and he will borrow of a friend, merely to be counted and then returned, a sufficient sum to make the sum square.

Try what you will, it will all fail till you demand the money—then, and not till then, the truth will come.

The sum of the whole matter, I take to be this: Under the Bank system, while sums of money, by the law, were permitted to lie in the hands of individuals, for very short periods only, many and very large defalcations occurred by those individuals.

Under the Sub-Treasury system, much larger sums are to lie in the hands of individuals for much longer periods, thereby multiplying temptation in proportion as the sums are larger; and multiplying opportunity in proportion as the periods are longer to, and for, those individuals to embezzle and escape with the public treasure; and, therefore, just in the proportion, that the temptation and the opportunity are greater under the Sub-Treasury than the Bank system, will the peculations and defalcations be greater under the former than they have been under the latter.

The truth of this, independent of actual experience, is but little less than self-evident. I therefore, leave it.

But it is said, and truly too, that there is to be a Penitentiary Department to the Sub-Treasury.

This, the advocates of the system will have it, will be a “king-cure-all.”

Before I go farther, may I not ask if the Penitentiary Department, is not itself an admission that they expect the public money to be stolen?

Why build the cage if they expect to catch no birds?

But to the question how effectual the Penitentiary will be in preventing defalcations.

How effectual have Penitentiaries heretofore been in preventing the crimes they were established to suppress? Has not confinement in them long been the legal penalty of larceny, forgery, robbery, and many other crimes, in almost all the States?

And yet, are not those crimes committed weekly, daily, nay, and even hourly, in every one of those States?

Again, the gallows has long been the penalty of murder, and yet we scarcely open a newspaper, that does not relate a new case of that crime.

If then, the Penitentiary has ever heretofore failed to prevent larceny, forgery and robbery, and the gallows and halter have likewise failed to prevent murder, by what process of reasoning, I ask, is it that we are to conclude the Penitentiary will hereafter prevent the stealing of the public money?

But our opponents seem to think they answer the charge, that the money will be stolen, fully, if they can show that they will bring the offenders to punishment.

Not so.

Will the punishment of the thief bring back the stolen money?

No more so than the hanging of a murderer restores his victim to life.

What is the object desired?

Certainly not the greatest number of thieves we can catch, but that the money may not be stolen.

If, then, any plan can be devised for depositing the public treasure, where it will be never stolen, never embezzled, is not that the plan to be adopted?

Turn, then, to a National Bank, and you have that plan, fully and completely successful, as tested by the experience of forty years.

I have now done with the three propositions that the Sub-Treasury would injuriously affect the currency, and would be more expensive and less secure as a depository of the public money than a National Bank.

How far I have succeeded in establishing their truth is for others to judge.

Omitting, for want of time, what I had intended to say as to the effect of the Sub-Treasury, to bring the public money under the more immediate control of the President, than it has ever heretofore been, I now only ask the audience, when Mr. Calhoun shall answer me, to hold him to the questions.

Permit him not to escape them. Require him either to show, that the Sub-Treasury would not injuriously affect the currency, or that we should in some way, receive an equivalent for that injurious effect.

Require him either to show that the Sub-Treasury would not be more expensive as a fiscal agent, than a Bank, or that we should, in some way be compensated for that additional expense.

And particularly require him to show, that the public money would be as secure in the Sub-Treasury as in a National Bank, or that the additional insecurity would be over-balanced by some good result of the proposed change.

No one of them, in my humble judgment, will he be able to do; and I venture the prediction, and ask that it may be especially noted, that he will not attempt to answer the proposition, that the Sub-Treasury would be more expensive than a National Bank as a fiscal agent of the Government.

The Constitutionality Question

As a sweeping objection to a National Bank, and consequently an argument in favor of the Sub-Treasury as a substitute for it, it often has been urged, and doubtless will be again, that such a bank is unconstitutional.

We have often heretofore shown, and therefore need not in detail do so again, that a majority of the Revolutionary patriarchs, whoever acted officially upon the question, commencing with Gen.

Washington and embracing Gen. Jackson, the larger number of the signers of the Declaration, and of the framers of the Constitution, who were in the Congress of 1791, have decided upon their oaths that such a bank is constitutional.

We have also shown that the votes of Congress have more often been in favor of than against its constitutionality.

In addition to all this we have shown that the Supreme Court—that tribunal which the Constitution has itself established to decide Constitutional questions—has solemnly decided that such a bank is constitutional.

Alexander Hamilton answered the question of the Bank’s constitutionality in 1791.

Protesting that these authorities ought to settle the question—ought to be conclusive, I will not urge them further now.

I now propose to take a view of the question which I have not known to be taken by anyone before.

It is, that whatever objection ever has or ever can be made to the constitutionality of a bank, will apply with force in its whole length, breadth, and proportions to the Sub-Treasury.

Our opponents say, there is no express authority in the Constitution to establish a Bank, and therefore a Bank is unconstitutional; but we, with equal truth, may say, there is no express authority in the Constitution to establish a Sub-Treasury, and therefore a Sub-Treasury is unconstitutional.

Who then, has the advantage of this “express authority” argument? Does it not cut equally both ways? Does it not wound them as deeply and as deadly as it does us?

Our position is that both are constitutional.

The Constitution enumerates expressly several powers which Congress may exercise, superadded to which is a general authority to make all laws necessary and proper, ”for carrying into effect all the powers vested by the Constitution of the Government of the United States. One of the express powers given Congress, is to lay and collect taxes; duties, imposts, and excises; to pay the debts, and provide for the common defence and general welfare of the United States.”

Now, Congress is expressly authorized to make all laws necessary and proper for carrying this power into execution.

To carry it into execution, it is indispensably necessary to collect, safely keep, transfer, and disburse a revenue.

To do this, a Bank is “necessary and proper.”

But, say our opponents, to authorize the making of a Bank, the necessity must be so great, that the power just recited, would be nugatory without it; and that that necessity is expressly negatived by the fact, that they have got along ten whole years without such a Bank. Immediately we turn on them, and say, that that sort of necessity for a Sub-Treasury does not exist, because we have got along forty whole years without one.

And this time, it may be observed, that we are not merely equal with them in the argument, but we beat them forty to ten, or which is the same thing, four to one.

On examination, it will be found, that the absurd rule, which prescribes that before we can constitutionally adopt a National Bank as a fiscal agent, we must show an indispensable necessity for it, will exclude every sort of fiscal agent that the mind of man can conceive.

A Bank is not indispensable, because we can take the Sub-Treasury; the Sub-Treasury is not indispensable because we can take the Bank. The rule is too absurd to need further comment.

Upon the phrase necessary and proper”, in the Constitution, it seems to me more reasonable to say, that some fiscal agent is indispensably necessary; but, inasmuch as no particular sort of agent is thus indispensable, because some other sort might be adopted, we are left to choose that sort of agent, which may be most proper” on grounds of expediency.

But it is said the Constitution gives no power to Congress to pass acts of incorporation.

Indeed!

What is the passing [of] an act of incorporation, but the making of a law?

Is anyone wise enough to tell?

The Constitution expressly gives Congress power to pass all laws necessary and proper”, etc.

If, then, the passing of a Bank charter, be the making a law necessary and proper,” is it not clearly within the constitutional power of Congress to do so? …

My Commitment

I shall advert to but one more point.

Mr. Lamborn refers to the late elections in the States, and from their results, confidently predicts, that every State in the Union will vote for Mr. Van Buren at the next Presidential election.

Address that argument to cowards and to knaves; with the free and the brave it will effect nothing. It may be true; if it must, let it.

Many free countries have lost their liberty; and ours may lose hers; but if she shall, be it my proudest plume, not that I was the last to desert, but that I never deserted her.

Lincoln in one of the last photographs by Alexander Gardner.

I know that the great volcano at Washington, aroused and directed by the evil spirit that reigns there, is belching forth the lava of political corruption, in a current broad and deep, which is sweeping with frightful velocity over the whole length and breadth of the land, bidding fair to leave unscathed no green spot or living thing, while on its bosom are riding like demons on the waves of Hell, the imps of that evil spirit, and fiendishly taunting all those who dare resist its destroying course, with the hopelessness of their effort; and knowing this, I cannot deny that all may be swept away.

Broken by it, I, too, may be; bow to it I never will.

The probability that we may fall in the struggle ought not to deter us from the support of a cause we believe to be just; it shall not deter me.

If ever I feel the soul within me elevate and expand to those dimensions not wholly unworthy of its Almighty Architect, it is when I contemplate the cause of my country, deserted by all the world beside, and I standing up boldly and alone and hurling defiance at her victorious oppressors.

Here, without contemplating consequences, before High Heaven, and in the face of the world, I swear eternal fidelity to the just cause, as I deem it, of the land of my life, my liberty, and my love.

And who, that thinks with me, will not fearlessly adopt the oath that I take. Let none falter, who thinks he is right, and we may succeed.

But, if after all, we shall fail, be it so.

We still shall have the proud consolation of saying to our consciences, and to the departed shade of our country’s freedom, that the cause approved of our judgment, and adored of our hearts, in disaster, in chains, in torture, in death, we NEVER faltered in defending.

***

By Nancy Spannaus

Published on American System Now

Republished by The 21st Century

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of 21cir.