In theory, the global financial system is supposed to help every country gain. Mainstream teaching of international finance, trade and “foreign aid” (defined simply as any government credit) depicts an almost utopian system uplifting all countries, not stripping their assets and imposing austerity.

The reality since World War I is that the United States has taken the lead in shaping the international financial system to promote gains for its own bankers, farm exporters, its oil and gas sector, and buyers of foreign resources – and most of all, to collect on debts owed to it.

Each time this global system has broken down over the past century, the major destabilizing force has been American over-reach and the drive by its bankers and bondholders for short-term gains. The dollar-centered financial system is leaving more industrial as well as Third World countries debt-strapped.

Its three institutional pillars – the International Monetary Fund (IMF), World Bank and World Trade Organization – have imposed monetary, fiscal and financial dependency, most recently by the post-Soviet Baltics, Greece and the rest of southern Europe.

The resulting strains are now reaching the point where they are breaking apart the arrangements put in place after World War II. The most destructive fiction of international finance is that all debts can be paid, and indeed should be paid, even when this tears economies apart by forcing them into austerity – to save bondholders, not labor and industry.

Yet European countries, and especially Germany, have shied from pressing for a more balanced global economy that would foster growth for all countries and avoid the current economic slowdown and debt deflation.

Imposing Austerity on Germany After World War I

After World War I the U.S. Government deviated from what had been traditional European policy – forgiving military support costs among the victors. U.S. officials demanded payment for the arms shipped to its Allies in the years before America entered the Great War in 1917.

The Allies turned to Germany for reparations to pay these debts. Headed by John Maynard Keynes, British diplomats sought to clean their hands of responsibility for the consequences by promising that all the money they received from Germany would simply be forwarded to the U.S. Treasury.

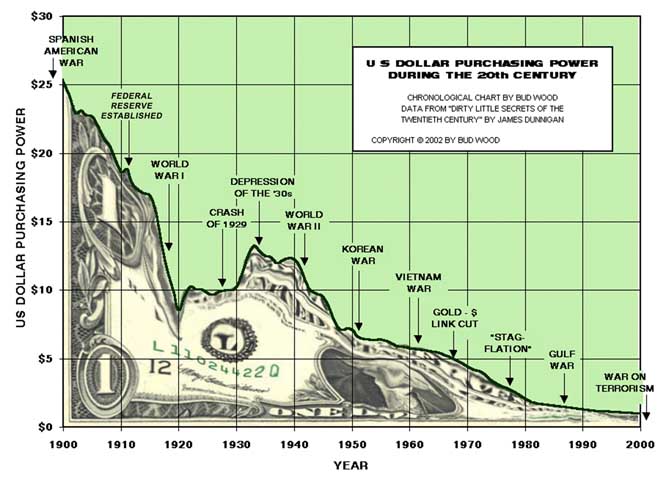

The sums were so unpayably high that Germany was driven into austerity and collapse. The nation suffered hyperinflation as the Reichsbank printed marks to throw onto the foreign exchange market. The currency declined, import prices soared, raising domestic prices as well.

The debt deflation was much like that of Third World debtors a generation ago, and today’s southern European PIIGS (Portugal, Ireland, Italy, Greece and Spain).

In a pretense that the reparations and Inter-Ally debt tangle could be made solvent, a triangular flow of payments was facilitated by a convoluted U.S. easy-money policy. American investors sought high returns by buying German local bonds; German municipalities turned over the dollars they received to the Reichsbank for domestic currency; and the Reichsbank used this foreign exchange to pay reparations to Britain and other Allies, enabling these countries to pay the United States what it demanded.

But solutions based on attempts to keep debts of such magnitude in place by lending debtors the money to pay can only be temporary. The U.S. Federal Reserve sustained this triangular flow by holding down U.S. interest rates. This made it attractive for American investors to buy German municipal bonds and other high-yielding debts.

It also deterred Wall Street from drawing funds away from Britain, which would have driven its economy deeper into austerity after the General Strike of 1926.

But domestically, low U.S. interest rates and easy credit spurred a real estate bubble, followed by a stock market bubble that burst in 1929. The triangular flow of payments broke down in 1931, leaving a legacy of debt deflation burdening the U.S. and European economies. The Great Depression lasted until outbreak of World War II in 1939.

Planning for the postwar period took shape as the war neared its end. U.S. diplomats had learned an important lesson. This time there would be no arms debts or reparations. The global financial system would be stabilized – on the basis of gold, and on creditor-oriented rules.

By the end of the 1940s the Untied States held some 75 percent of the world’s monetary gold stock. That established the U.S. dollar as the world’s reserve currency, freely convertible into gold at the 1933 parity of $35 an ounce.

It also implied that once again, as in the 1920s, European balance-of-payments deficits would have to be financed mainly by the United States. Recycling of official government credit was to be filtered via the IMF and World Bank, in which U.S. diplomats alone had veto power to reject policies they found not to be in their national interest. International financial “stability” thus became a global control mechanism – to maintain creditor-oriented rules centered in the United States.

To obtain gold or dollars as backing for their own domestic monetary systems, other countries had to follow the trade and investment rules laid down by the United States. These rules called for relinquishing control over capital movements or restrictions on foreign takeovers of natural resources and the public domain as well as local industry and banking systems.

By 1950 the dollar-based global economic system had become increasingly untenable. Gold continued flowing to the United States, strengthening the dollar – until the Korean War reversed matters. From 1951 through 1971 the United States ran a deepening balance-of-payments deficit, which stemmed entirely from overseas military spending. (Private-sector trade and investment was steadily in balance.)

U.S. Treasury Debt Replaces the Gold Exchange Standard

The foreign military spending that helped return American gold to Europe became a flood as the Vietnam War spread across Asia after 1962. The Treasury kept the dollar’s exchange rate stable by selling gold via the London Gold Pool at $35 an ounce. Finally, in August 1971, President Nixon stopped the drain by closing the Gold Pool and halting gold convertibility of the dollar.

There was no plan for what would happen next. Most observers viewed cutting the dollar’s link to gold as a defeat for the United States. It certainly ended the postwar financial order as designed in 1944. But what happened next was just the reverse of a defeat.

No longer able to buy gold after 1971 (without inciting strong U.S. disapproval), central banks found only one asset in which to hold their balance-of-payments surpluses: U.S. Treasury debt. These securities no longer were “as good as gold.” The United States issued them at will to finance soaring domestic budget deficits.

By shifting from gold to the dollars thrown off by the U.S. balance-of-payments deficit, the foundation of global monetary reserves came to be dominated by the U.S. military spending that continued to flood foreign central banks with surplus dollars. America’s balance-of-payments deficit thus supplied the dollars that financed its domestic budget deficits and bank credit creation – via foreign central banks recycling U.S. foreign spending back to the U.S. Treasury.

In effect, foreign countries have been taxed without representation over how their loans to the U.S. Government are employed. European central banks were not yet prepared to create their own sovereign wealth funds to invest their dollar inflows in foreign stocks or direct ownership of businesses. They simply used their trade and payments surpluses to finance the U.S. budget deficit. This enabled the Treasury to cut domestic tax rates, above all on the highest income brackets.

U.S. monetary imperialism confronted European and Asian central banks with a dilemma that remains today: If they do not turn around and buy dollar assets, their currencies will rise against the dollar. Buying U.S. Treasury securities is the only practical way to stabilize their exchange rates – and in so doing, to prevent their exports from rising in dollar terms and being priced out of dollar-area markets.

The system may have developed without foresight, but quickly became deliberate. My book Super Imperialismsold best in the Washington DC area, and I was given a large contract through the Hudson Institute to explain to the Defense Department exactly how this extractive financial system worked. I was brought to the White House to explain it, and U.S. geostrategists used my book as a how-to-do-it manual (not my original intention).

Attention soon focused on the oil-exporting countries. After the U.S. quadrupled its grain export prices shortly after the 1971 gold suspension, the oil-exporting countries quadrupled their oil prices. I was informed at a White House meeting that U.S. diplomats had let Saudi Arabia and other Arab countries know that they could charge as much as they wanted for their oil, but that the United States would treat it as an act of war not to keep their oil proceeds in U.S. dollar assets.

This was the point at which the international financial system became explicitly extractive. But it took until 2009, for the first attempt to withdraw from this system to occur. A conference was convened at Yekaterinburg, Russia, by the Shanghai Cooperation Organization (SCO). The alliance comprised Russia, China, Kazakhstan, Tajikistan, Kirghizstan and Uzbekistan, with observer status for Iran, India, Pakistan and Mongolia. U.S. officials asked to attend as observers, but their request was rejected.

The U.S. response has been to extend the new Cold War into the financial sector, rewriting the rules of international finance to benefit the United States and its satellites – and to deter countries from seeking to break free from America’s financial free ride.

The IMF Changes Its Rules to Isolate Russia and China

Aiming to isolate Russia and China, the Obama Administration’s confrontational diplomacy has drawn the Bretton Woods institutions more tightly under US/NATO control. In so doing, it is disrupting the linkages put in place after World War II.

The U.S. plan was to hurt Russia’s economy so much that it would be ripe for regime change (“color revolution”). But the effect was to drive it eastward, away from Western Europe to consolidate its long-term relations with China and Central Asia.

Pressing Europe to shift its oil and gas purchases to U.S. allies, U.S. sanctions have disrupted German and other European trade and investment with Russia and China. It also has meant lost opportunities for European farmers, other exporters and investors – and a flood of refugees from failed post-Soviet states drawn into the NATO orbit, most recently Ukraine.

To U.S. strategists, what made changing IMF rules urgent was Ukraine’s $3 billion debt falling due to Russia’s National Wealth Fund in December 2015. The IMF had long withheld credit to countries refusing to pay other governments. This policy aimed primarily at protecting the financial claims of the U.S. Government, which usually played a lead role in consortia with other governments and U.S. banks.

But under American pressure the IMF changed its rules in January 2015. Henceforth, it announced, it would indeed be willing to provide credit to countries in arrears other governments – implicitly headed by China (which U.S. geostrategists consider to be their main long-term adversary), Russia and others that U.S. financial warriors might want to isolate in order to force neoliberal privatization policies.[1]

Article I of the IMF’s 1944-45 founding charter prohibits it from lending to a member engaged in civil war or at war with another member state, or for military purposes generally. An obvious reason for this rule is that such a country is unlikely to earn the foreign exchange to pay its debt. Bombing Ukraine’s own Donbass region in the East after its February 2014 coup d’état destroyed its export industry, mainly to Russia.

Withholding IMF credit could have been a lever to force adherence to the Minsk peace agreements, but U.S. diplomacy rejected that opportunity. When IMF head Christine Lagarde made a new loan to Ukraine in spring 2015, she merely expressed a verbal hope for peace. Ukrainian President Porochenko announced the next day that he would step up his civil war against the Russian-speaking population in eastern Ukraine.

One and a half-billion dollars of the IMF loan were given to banker Ihor Kolomoiski and disappeared offshore, while the oligarch used his domestic money to finance an anti-Donbass army. A million refugees were driven east into Russia; others fled west via Poland as the economy and Ukraine’s currency plunged.

The IMF broke four of its rules by lending to Ukraine:

(1) Not to lend to a country that has no visible means to pay back the loan (the “No More Argentinas” rule, adopted after the IMF’s disastrous 2001 loan to that country). (2) Not to lend to a country that repudiates its debt to official creditors (the rule originally intended to enforce payment to U.S.-based institutions). (3) Not to lend to a country at war – and indeed, destroying its export capacity and hence its balance-of-payments ability to pay back the loan. Finally (4), not to lend to a country unlikely to impose the IMF’s austerity “conditionalities.” Ukraine did agree to override democratic opposition and cut back pensions, but its junta proved too unstable to impose the austerity terms on which the IMF insisted.

U.S. Neoliberalism Promotes Privatization Carve-Ups of Debtor Countries

Since World War II the United States has used the Dollar Standard and its dominant role in the IMF and World Bank to steer trade and investment along lines benefiting its own economy. But now that the growth of China’s mixed economy has outstripped all others while Russia finally is beginning to recover, countries have the option of borrowing from the Asian Infrastructure Investment Bank (AIIB) and other non-U.S. consortia.

At stake is much more than just which nations will get the contracting and banking business. At issue is whether the philosophy of development will follow the classical path based on public infrastructure investment, or whether public sectors will be privatized and planning turned over to rent-seeking corporations.

What made the United States and Germany the leading industrial nations of the 20th century – and more recently, China – has been public investment in economic infrastructure. The aim was to lower the price of living and doing business by providing basic services on a subsidized basis or freely.

By contrast, U.S. privatizers have brought debt leverage to bear on Third World countries, post-Soviet economies and most recently on southern Europe to force selloffs. Current plans to cap neoliberal policy with the Trans-Pacific Partnership (TPP), Transatlantic Trade and Investment Partnership (TTIP) and Transatlantic Free Trade Agreement (TAFTA) go so far as to disable government planning power to the financial and corporate sector.

American strategists evidently hoped that the threat of isolating Russia, China and other countries would bring them to heel if they tried to denominate trade and investment in their own national currencies. Their choice would be either to suffer sanctions like those imposed on Cuba and Iran, or to avoid exclusion by acquiescing in the dollarized financial and trade system and its drives to financialize their economies under U.S. control.

The problem with surrendering is that this Washington Consensus is extractive and lives in the short run, laying the seeds of financial dependency, debt-leveraged bubbles and subsequent debt deflation and austerity. The financial business plan is to carve out opportunities for price gouging and corporate profits.

Today’s U.S.-sponsored trade and investment treaties would make governments pay fines equal to the amount that environmental and price regulations, laws protecting consumers and other social policies might reduce corporate profits. “Companies would be able to demand compensation from countries whose health, financial, environmental and other public interest policies they thought to be undermining their interests, and take governments before extrajudicial tribunals.

These tribunals, organised under World Bank and UN rules, would have the power to order taxpayers to pay extensive compensation over legislation seen as undermining a company’s ‘expected future profits.’”[2]

This policy threat is splitting the world into pro-U.S. satellites and economies maintaining public infrastructure investment and what used to be viewed as progressive capitalism. U.S.-sponsored neoliberalism supporting its own financial and corporate interests has driven Russia, China and other members of the Shanghai Cooperation Organization into an alliance to protect their economic self-sufficiency rather than becoming dependent on dollarized credit enmeshing them in foreign-currency debt.

At the center of today’s global split are the last few centuries of Western social and democratic reform. Seeking to follow the classical Western development path by retaining a mixed public/private economy, China, Russia and other nations find it easier to create new institutions such as the AIIB than to reform the dollar standard IMF and World Bank. Their choice is between short-term gains by dependency leading to austerity, or long-term development with independence and ultimate prosperity.

The price of resistance involves risking military or covert overthrow. Long before the Ukraine crisis, the United States has dropped the pretense of backing democracies. The die was cast in 1953 with the coup against Iran’s secular government, and the 1954 coup in Guatemala to oppose land reform.

Support for client oligarchies and dictatorships in Latin America in the 1960 and ‘70s was highlighted by the overthrow of Allende in Chile and Operation Condor’s assassination program throughout the continent. Under President Barack Obama and Secretary of State Hillary Clinton, the United States has claimed that America’s status as the world’s “indispensible nation” entitled it back the recent coups in Honduras and Ukraine, and to sponsor the NATO attack on Libya and Syria, leaving Europe to absorb the refugees.

Germany’s Choice

This is not how the Enlightenment was supposed to evolve. The industrial takeoff of Germany and other European nations involved a long fight to free markets from the land rents and financial charges siphoned off by their landed aristocracies and bankers.

That was the essence of classical 19th-century political economy and 20th-century social democracy. Most economists a century ago expected industrial capitalism to produce an economy of abundance, and democratic reforms to endorse public infrastructure investment and regulation to hold down the cost of living and doing business.

But U.S. economic diplomacy now threatens to radically reverse this economic ideology by aiming to dismantle public regulatory power and impose a radical privatization agenda under the TTIP and TAFTA.

Textbook trade theory depicts trade and investment as helping poorer countries catch up, compelling them to survive by becoming more democratic to overcome their vested interests and oligarchies along the lines pioneered by European and North American industrial economies. Instead, the world is polarizing, not converging.

The trans-Atlantic financial bubble has left a legacy of austerity since 2008. Debt-ridden economies are being told to cope with their downturns by privatizing their public domain.

The immediate question facing Germany and the rest of Western Europe is how long they will sacrifice their trade and investment opportunities with Russia, Iran and other economies by adhering to U.S.-sponsored sanctions. American intransigence threatens to force an either/or choice in what looms as a seismic geopolitical shift over the proper role of governments: Should their public sectors provide basic services and protect populations from predatory monopolies, rent extraction and financial polarization?

Today’s global financial crisis can be traced back to World War I and its aftermath. The principle that needed to be voiced was the right of sovereign nations not to be forced to sacrifice their economic survival on the altar of inter-government and private debt demands.

The concept of nationhood embodied in the 1648 Treaty of Westphalia based international law on the principle of parity of sovereign states and non-interference. Without a global alternative to letting debt dynamics polarize societies and tear economies apart, monetary imperialism by creditor nations is inevitable.

The past century’s global fracture between creditor and debtor economies has interrupted what seemed to be Europe’s democratic destiny to empower governments to override financial and other rentier interests. Instead, the West is following U.S. diplomatic leadership back into the age when these interests ruled governments.

This conflict between creditors and democracy, between oligarchy and economic growth (and indeed, survival) will remain the defining issue of our epoch over the next generation, and probably for the remainder of the 21st Cenntury.

Michael Hudson is President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City and author of J is Junk Economics (2017), Killing the Host (2015), The Bubble and Beyond (2012), Super-Imperialism: The Economic Strategy of American Empire (1968 & 2003), Trade, Development and Foreign Debt (1992 & 2009) and of The Myth of Aid (1971), amongst many others. http://michael-hudson.com

This article is adapted from the German edition of Super-Imperialism (2017).

Notes.

[1] I provide the full background in “The IMF Changes its Rules to Isolate China and Russia,” December 9, 2015, available on michael-hudson.com, Naked Capitalism, Counterpunch and Johnson’s Russia List.

[2] Lori M. Wallach, “The corporation invasion,” La Monde Diplomatique, December 2, 2013, http://mondediplo.com/2013/12/02tafta. She adds: “Some investors have a very broad conception of their rights. European companies have recently launched legal actions against the raising of the minimum wage in Egypt; Renco has fought anti-toxic emissions policy in Peru, using a free trade agreement between that country and the US to defend its right to pollute (6). US tobacco giant Philip Morris has launched cases against Uruguay and Australia over their anti-smoking legislation.” See also Yves Smith, “Germany Bucking Toxic, Nation-State Eroding Transatlantic Trade and Investment Partnership,” Naked Capitalism, July 17, 2014, and “Germany Turning Sour on the Transatlantic Trade and Investment Partnership,” Naked Capitalism, October 30, 2014.