It’s tough to keep up with the conspiracy theories that run rampant from day to day in the hallowed halls of Congress. But one that is gaining traction is that the U.S. Treasury Department’s Financial Stability Oversight Council (whose acronym is pronounced F-SOC) is the handmaiden of an international finance cabal and is obediently marching to its beat instead of the mandates of Congress.

These suspicions were on display at the Senate Banking Committee hearing last Wednesday and the House Financial Services Committee hearing the week before where U.S. Treasury Secretary Jack Lew, who Chairs F-SOC, was pummeled with thinly veiled, and not so thinly veiled, accusations.

F-SOC was created under the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. It is charged with the early identification of emerging risks to the financial system. Every major regulator of Wall Street banks has a seat.

The conspiracy theory that foreign hot shots are really controlling decisions at F-SOC is not without roots. The international equivalent of F-SOC is the Financial Stability Board, which is run by a Plenary of central bankers and finance ministers from around the globe, along with organizations like the International Monetary Fund (IMF), World Bank and Basel Committee on Banking Supervision. The United States has three members on the Plenary: Nathan Sheets, the Undersecretary for International Affairs at the U.S. Treasury; Daniel Tarullo, a member of the Board of Governors of the Federal Reserve; and Mary Jo White, Chair of the SEC. Mark Carney, the Governor of the Bank of England is the current Chair of the Financial Stability Board.

The simmering conspiracy took wings on February 5 of this year when Mark Carney issued what appeared to be marching orders from the Financial Stability Board to G20 members, which includes the United States. One portion of the document reads as follows:

“At the Brisbane Summit, two crucial elements of the policy framework to end too-big-to-fail were agreed: a proposal for a common international standard on the total loss-absorbing capacity that globally systemic banks must have; and an industry agreement that will prevent cross-border derivative contracts from being terminated disruptively in the event of a globally systemic bank entering resolution. In 2015, we must bring this progress to finalisation. By the Antalya Summit: The FSB will finalise the international standard for total loss-absorbing capacity of global systemically important banks; FSB members will take measures to promote industry adoption of contractual provisions recognising temporary stays on the close-out of financial contracts when a firm enters resolution.”

This certainly sounds like the FSB is calling the shots.

At the Senate Banking hearing on Wednesday, it became clear that the conspiracy theory has spread to at least one trade group, the American Council of Life Insurers. Gary Hughes, the Executive Vice President and General Counsel of the trade group submitted written testimony that included this excerpt:

“FSOC’s determinations should be independent of international regulatory actions…the lack of transparency in FSOC’s designation process and the thinly-reasoned explanations in its designation decisions support the concern voiced by some that FSOC’s designations have been preordained by actions of an international regulatory entity, the Financial Stability Board (FSB). The member of FSOC with insurance expertise, Roy Woodall, expressed this concern in his dissent to the Prudential designation.

“The U.S. Department of Treasury and the Federal Reserve Board are both important participants in the FSB, which in 2013, issued an initial list of insurance companies that the organization considered to be ‘global systemically important insurers.’ AIG, Prudential, and MetLife were all on the FSB’s list. Those companies’ designations as SIFIs should have been based on the statutory requirements of the Dodd-Frank Act, which differ meaningfully from the standards FSB has said it applies. Yet, there is ground for concern that leading participants in FSOC were committed to designating as systemic under Dodd-Frank those companies that they had already agreed to designate as systemic through the FSB process. FSOC should not be outsourcing to foreign regulators important decisions about which U.S. companies are to be subject to heightened regulation…”

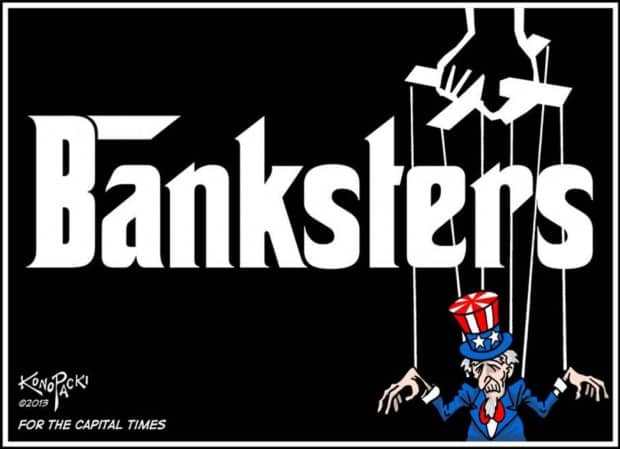

The conspiracy theory that an international financial cabal is supplanting the legislative will of Congress has an important competing theory. That is, that a Wall Street cabal of lobbyists, deep-pocketed bank CEOs and hedge fund billionaires are pulling the strings in our Congress behind a dark curtain. The fact that Citigroup was able to gut a key portion of Dodd-Frank’s reform of derivatives recently by sneaking the measure into a critical funding bill to keep the government operating, would appear to prove the point.

And there is yet a third theory. This one goes like this: Wall Street is perceived by our foreign allies to so completely control Congress that foreign financial markets simply do not trust U.S. regulators to rein in Wall Street abuses or prevent another systemic financial collapse. The Financial Stability Board feels it must look over Wall Street’s shoulder because it can’t trust Congress or the Federal Reserve to do their job.

By Pam Martens and Russ Martens

http://wallstreetonparade.com/2015/03/paranoia-reigns-in-congress-over-an-international-financial-cabal/