Beginning in earnest in the late Seventies, a sustained and pervasive ideological attack was mounted against the role of the State in managing economic affairs. The terms of the attack ranged from ethical and philosophical arguments about individual liberty and property rights to more pragmatic arguments about the supposed economic advantages of private ownership, deregulation of capital and flattened fiscal regimes.

Alternative visions of the role of the State were marginalised and discounted as either economically misguided or politically totalitarian.

The emerging consensus became known as Neo-Liberalism, or Economic Rationalism. It had its intellectual progenitors – Adam Smith, the Austrian and Chicago Schools, Ayn Rand; its political trail-blazers – Pinochet, Thatcher and Reagan, and its demons – Socialists, Marxists and Keynesians.

When the Berlin Wall came down, and the ‘evil empire’ collapsed, it seemed that the ideological battle had been won – the deprived masses of the Socialist bloc had overthrown their Orwellian masters and would readily embrace the new credo.

Ahead lay a brave, new, unipolar world in which largely unregulated markets would constitute the bedrock of a free, dynamic and innovative global economic order in which social wealth would be maximised.

In due course, after some initial resistance, the centre-left caved in to the Neo-Liberal gospel, especially in the Anglosphere, always the geopolitical fulcrum of the Neo-Liberal order. By the mid 90′s the centre-left in the UK, USA and Australia were committed to an economic program that was virtually indistinguishable from the Reagan/Thatcher platform of the previous decade, all be it dressed up in a more progressive social liberalism.

The reason that so many ‘social-democrats’ and ‘socialists’ embraced the Neo-Liberal revolution is that they came to accept its core claim that not only is capitalism the most effective way of generating wealth but that, contrary to now supposedly outmoded Keynesian and socialist views, it is also the best way of actually spreading the benefits of that wealth as widely as possible.

There are no losers – everyone’s a winner. The view is that governments don’t create wealth – they just spend it on coercing people and distorting market mechanisms that would otherwise produce greater social utility.

By extracting the State from economic activity and allowing a more lightly regulated capitalism to structure production, distribution, exchange and finance, everyone is actually better off. The market mechanism can even play a positive role in improving social services like health and education, and providing essential infrastructure like transport, communications and energy – all with minimal regulatory regimes.

Under cover of this ideological offensive, the entire post-war Bretton-Woods economic order was dismantled. Capital controls were removed, public assets and infrastructure privatised and markets deregulated. Manufacturing and back-office functions were offshored. Organised labour was suppressed by legislation and by exporting traditional unionised industries to low-cost non-unionised labour markets.

In addition to the huge profits to be made from deploying capital to low-wage economies, this also made it possible for capital to significantly increase the rate of surplus value extraction in the developed economies.

The monetary value of what labour was making began to grow much more quickly than the monetary wage cost of the labour itself. Now that most consumer goods – for example clothing, electronic goods and household items – were produced cheaply in low-cost markets, the living costs of the developed economy worker were kept low, alleviating pressure on wages. It was a win/win for capital.

Consequently, for 40 years real wages in the developed world have been virtually stagnant – especially in the USA. In fact, income as a share of GDP has been in steady decline in many developed economies. Labour was producing more commodities than it had the monetary means to purchase, because an increasing share of the monetised value of commodities was being realised as capital, not wages. Inequality between capital and labour was further exacerbated by huge cuts in marginal tax rates and corporate taxes.

This is where the financial system stepped in to eliminate potential under-consumption. By leveraging capital sourced from expanding corporate profits and the personal wealth of the super-rich, the banks began to sell huge quantities of lucrative debt to the working class, enabling the latter to buy back the product of its own labour and keep capital accumulation ticking over.

Credit controls were relaxed leading to massive asset bubbles in property and consumer spending, which in turn spawned a parasitic, multi-trillion dollar shadow banking economy of ‘collateralised debt obligations’ (CDO’s) – tranched securities built from bundles of debt.

These in turn spawned another equally large market in ‘credit default swaps’ (CDS’s) in which entities offered to ‘insure’ securities, even though the ‘insurance-buyer’ was often not even the owner of the reference assets, and the ‘insurance provider’ was not able to underwrite the debt ‘insured’. It wasn’t actually called ‘insurance’, so it didn’t fall under any insurance regulatory regime.

In fact, most of the trade in CDO’s and CDS’s was wholly unregulated, taking place ‘over the counter’ rather than in organised exchanges.

As if the bankers were not getting rich enough from buying and selling consumer and property debt, they also branched out into buying and selling student debt – a new concept for most of Europe, which had previously operated under the assumption that tertiary education should be publically funded.

The property asset bubble, limitless personal credit lines, and the market in low cost consumer goods kept the developed world working class largely integated into the capitalist order. Real wages were stagnant and labour was being deprived of an increasing share of the value it created, but as long as property values were rising and credit card limits expanding there was always a source of liquidity to make up the difference.

If you didn’t own a property, the answer was to work harder and longer and borrow the money to buy one – to ‘get on the property ladder’.

In 2007/8, the massive Ponzi scheme collapsed. Trillions of dollars were wiped off the market. The immediate cause of the collapse was over-leveraged household debt. Working class homebuyers in the USA began to foreclose. They had been sold mortgages on ‘teaser’ interest rates by brokers making a living flipping mortgages to CDO funds.

The homeowners on teaser rates couldn’t actually afford the mortgage repayments at the market rate – they were relying on property values increasing so they could refinance once the teaser rate expired.

As foreclosures spread, property values actually dropped, leading to more foreclosures, leading to further drops. Suddenly, trillions of dollars of CDO’s began to lose value across the board as debts went toxic, debt repayment flows dried up and asset values collapsed. When large numbers of CDO holders tried to cash in their CDS’s the underwritten cash sums simply didn’t exist – the money wasn’t there. Exit AIG, the largest insurance company in the world. Banks stopped lending to each other because they all knew how heavily leveraged they were, and they all knew that the leveraged debt was going toxic. The financial system was deadlocked.

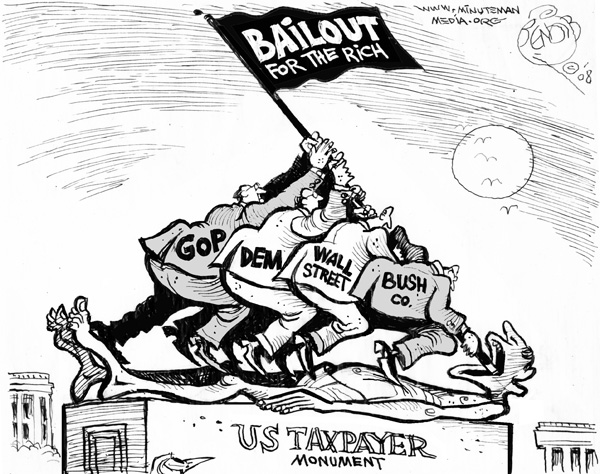

It then became clear that when the Neo-Liberals said that government interference in the economy is a bad thing, what they really meant to say is that it is a bad thing when it is for the benefit of labour. It turns out that it is in fact a very good thing when it is done in order to save the capitalist system from falling on its own sword. That would appear to be the only explanation for what followed – the biggest government bail out in modern economic history.

All the money that hadn’t been available for manufacturing, for healthcare, for education, for infrastructure – suddenly became available to save the banking system. The Federal Reserve, Bank of England and European Central Bank have, in the last 6 years, created trillions of dollars and handed them straight to the bankers. The process is called quantitative easing.

The central banks create money via a digital book entry, and then use the money to purchase commercial paper from the banking sector – typically government and corporate bonds, but also CDO’s.

This does two things. Firstly, it means that governments and corporations can raise credit cheaply, because the buyer of the debt knows they can flip it to the central bank and earn a return. This keeps interest rates low. Secondly, it injects liquidity into the banking system and keeps the business cycle going.

In the meantime, it’s austerity for the rest of us, as costs are driven down to encourage business investment and governments cut back on social programs in order to finance their ever growing debts.

It will be recalled that the ‘useful idiots’ of Neo-Liberalism – the centre-left that abandoned not just socialism but any semblance of Keynesianism – bought into the idea that privatisation, deregulation and flattened fiscal regimes were all consistent with traditional centre-left values of economic justice and equity.

As it happens, there is overwhelming evidence that they were completely wrong.

In January of this year, Oxfam published a briefing paper called ‘Working for the Few’ (http://www.oxfam.org/sites/www.oxfam.org/files/bp-working-for-few-political-capture-economic-inequality-200114-en.pdf ).

The paper was released to coincide with the 2014 World Economic Forum at Davos, the premier public social event for self-respecting members of the global elite.

The paper is based on the tactical idea that the World Economic Forum is part of the solution, which rather flies in the face of the commonplace historical observation that, with some notable individual exceptions, the rich and powerful are not given to fundamentally questioning the structures that support their wealth and power.

Having said that, the report is a stunning indictment of the Neo-Liberal deception.

In the opening executive summary the reader is informed that:

Almost half of the world’s wealth is now owned by just one percent of the population.

The wealth of the one percent richest people in the world amounts to $110 trillion. That’s 65 times the total wealth of the bottom half of the world’s population.

The bottom half of the world’s population owns the same as the richest 85 people in the world.

Seven out of ten people live in countries where economic inequality has increased in the last 30 years.

The richest one percent increased their share of income in 24 out of 26 countries for which we have data between 1980 and 2012.

In the US, the wealthiest one percent captured 95 percent of post-financial crisis growth since 2009, while the bottom 90 percent became poorer.

In the ‘People’s Republic’ of China, now firmly established as an integral component of the world capitalist order, supplying cheap consumer goods to the US/EU economies and using its massive US dollar foreign exchange reserves to help bankroll the US/NATO war machine, the report states that the richest 1% have more than doubled their share of national income since 1980.

The report reveals the stunning fact that 18.5 trillion dollars – a sum greater than total US GDP, is held unrecorded and offshore in tax havens – the lion’s share held in a network of current and former British possessions – Hong Kong, The Cayman Islands, Singapore, Jersey, Bermuda and Guernsey.

As for the distribution of wealth, 10% of the global population control 86% of total global assets, whilst the bottom 70% control just 3%.

Regarding the increased rate of surplus value extraction from developed economy labour, and its relationship to the offshoring of manufacturing and anti-union leglislation, the report explains that:

A report from the International Labour Organization (ILO) shows that between 1989 and 2005, union density (a measure of the membership of trade unions which represents union membership in relation to the total labor force) mostly declined in countries for which data are available, and that union density is negatively correlated with income inequality.

Power relations between owners of capital and workers have changed dramatically in the past three decades in many countries, mostly as economies have moved from manufacturing to services, and as globalization has allowed for outsourcing of jobs. This is reflected in the decreasing share of income going to labor: over the past three decades, wages, salaries and benefits represent a smaller share of national income in nearly all ILO member countries.

There is, however, one region that is bucking the trend and that just happens to be the region of the world in which significant elements have bucked the trend to Neo-Liberalism and are turning to the Left – Latin America. The report explains that:

growth of tax revenues in Latin America has been the fastest in the world, and this growth has translated to higher spending to reduce inequality. For instance, between 2002 and 2011, income inequality dropped in 14 of the 17 countries where there is comparable data.During this period, approximately 50 million people moved into the middle class, meaning that for the first time ever, more people in the region belong to the middle class than are living in poverty.

The report continues:

By some estimates, social spending as a percentage of GDP across Latin American countries increased by 66 percent over the past twenty years. The impact is noticeable, given that not long ago the region had among the lowest public spending levels in the world. Increased spending on health and education has had the greatest impact on inequality reduction.

The report concludes with a set of recommendations, including:

• Stronger regulation of markets;

• Curbing the power of the rich to influence political processes and policies that best suit their interests.

• Cracking down on financial secrecy and tax dodging;

• Redistributive transfers; and strengthening of social protection schemes;

• Investment in universal access to free healthcare and education;

• Progressive taxation;

• Strengthening wage floors and worker rights;

This is, of course, the complete opposite of the Neo-Liberal prescriptions that have seduced significant elements of the so-called ‘left’ for the last 20 years.

The fact is that ‘we’ allowed the global super-rich to screw us, and then we bailed them out when the system that made them rich was in danger of collapsing. They got richer and richer, while we were bought off with the illusion of increasing wealth, when the reality is that we have been getting a declining share of the wealth we actually produce.

For years we have been told there was no money for social programs, and that our children had to pay to go to university, while trillions were spent on USA/NATO imperial wars and capitalist banker bailouts, and further trillions were hidden away in largely British-connected tax havens.

We should all be very angry with the Neo-Liberals

Mr. Lionel Reynolds who is one of the frequent contributors for The 4th Media writes the www.dispatchesfromempire.com blog.